What is a Cost Breakdown Structure?

In production, a Cost Breakdown Structure (CBS), or should-cost analysis, is an organized framework breaking down all the costs incurred in production. Every element is a certain cost category, allowing manufacturers to estimate the overall actual cost better.

By breaking down costs into direct expenses and indirect costs, a CBS gives detailed insight into financial outlays. This level of detail supports cost control, budget forecasting, and financial risk management across the life cycle of production.

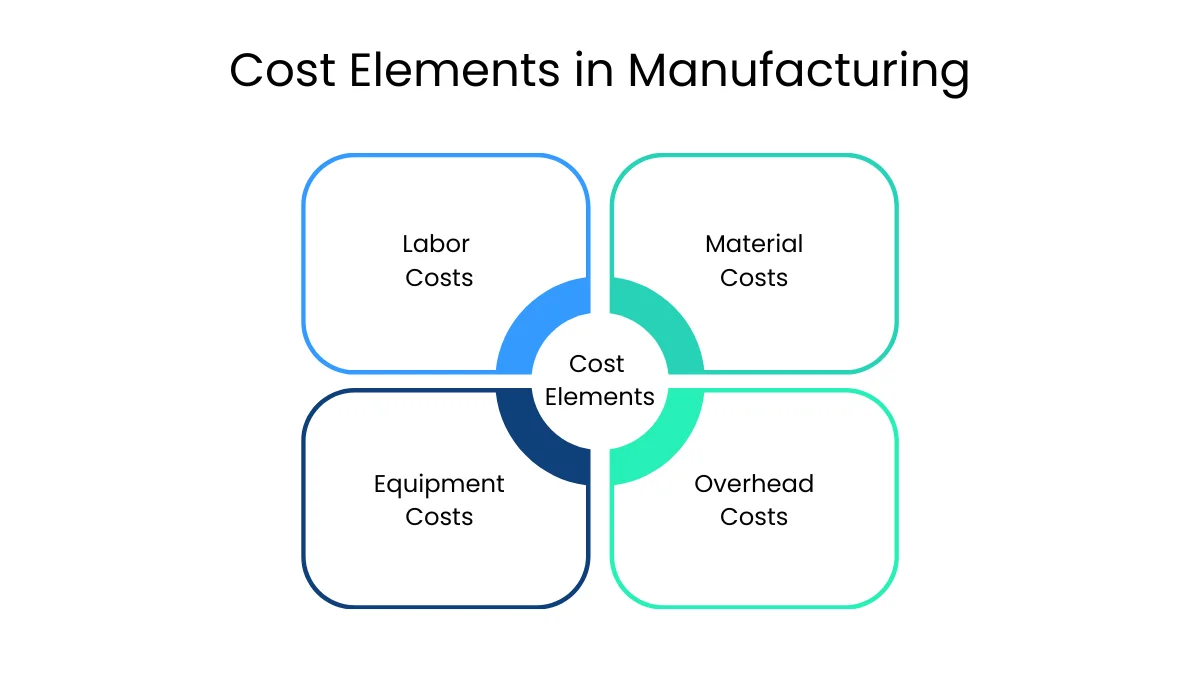

Major Cost Elements in a Manufacturing Cost Breakdown Structure (CBS)

Project costs in manufacturing need to be estimated, bearing in mind various categories of expenses. A well-planned CBS will help ensure that all the cost items are covered so that budget overruns and financial errors are avoided. Below is a description of the major cost elements:

1. Labor Costs

Labor is usually one of the major costs in manufacturing. Inaccurate estimation can easily balloon labor costs, taking the project beyond its intended budget.

In a CBS, labor expenses are segmented according to roles, e.g., machine operators, technicians, and assembly workers, along with their hourly wage and estimated number of work hours. Labor is directly related to production and, therefore, is a direct cost.

2. Material Costs

Materials represent all raw materials needed to manufacture the end product. These can be classified into:

- Physical materials: Base materials such as plastics, metals, and electronic items used physically during production.

- Intangible materials: Expenses of necessary non-physical assets such as licensing, intellectual property, and insurance.

Including tangible as well as intangible material costs guarantees a better cost estimate.

3. Equipment Costs

While some manufacturers include equipment costs under materials, keeping them separate in the CBS provides a clearer picture of capital expenditures. This category includes all machinery, tools, and specialized equipment used in production.

If certain machines require upgrades or maintenance during the project, those costs should also be allocated under this category to accurately reflect the total investment.

4. Overhead Costs

Overhead expenses may not be specifically linked to production but are necessary for operation. They are:

- Facility costs like rent and utilities (electricity, water, and internet)

- Administrative costs, such as office supplies and software subscriptions

- Indirect expenses like security, maintenance, and quality control

Although overhead expenses do not directly add to a specific product, they must be included to obtain a realistic estimate of the overall manufacturing budget.

By organizing costs in a CBS, manufacturers have complete visibility of project costs, which enables improved financial planning and optimized resource allocation.

Step-by-Step Process for Creating a CBS

Not all businesses depend on a Cost Breakdown Structure (CBS) for planning projects. A few depend on a Work Breakdown Structure (WBS), which breaks tasks and deliverables hierarchically. Though a WBS gives a defined project structure, it does not have the fiscal depth to budget correctly. A CBS, however, works in conjunction with a WBS to give instant cost analysis with greater fiscal depth.

Here’s a step-by-step method for building a trustworthy CBS for manufacturing projects:

1. Define the Project Scope

Almost 40% of businesses don’t define a project scope before implementation. Omitting this step results in budget blowouts and resource wastage. A well-defined scope avoids scope creep and ensures that all stakeholders fully understand project expectations.

To build a sound scope:

- Establish well-defined goals: Determine what success is and what the major deliverables are.

- Develop resource allocation planning: Determine the needed materials, equipment, and staff.

- Create a scope statement: Detail what is in and out of the project.

- Obtain stakeholder buy-in: Get alignment with decision-makers early to avoid changes down the road.

- Put in place a change control process: Big projects must undergo changes, so create a method for effectively handling modifications.

2. Identify Key Cost Categories

Allocating costs into cost categories makes expenses easier to trace and avoids surprising budgets. The main cost categories used in manufacturing include:

- Raw materials: Pieces such as metal, plastic, and chemicals to be used during production.

- Labor: Salaries for operators, engineers, and technicians working on the project.

- Equipment: Plant, tools, and maintenance costs necessary for production.

- Overhead: Overheads like rent charges, utilities, and administrative expenditures.

3. Allocate Monetary Value to Each Cost Category

After defining cost categories, the second step is to place accurate monetary values. This entails a task breakdown and the estimation of costs for each element. Several cost estimation methods can be used, such as:

- Parametric estimation: Utilizes historical data, scaled for variations, to estimate costs.

- Analogous estimation: Uses previous project data to estimate time to completion and cost.

- Expert judgment: Uses experienced project managers to make educated cost estimates.

- Three-point estimation: Averages an estimate based on optimistic, most likely, and pessimistic cost estimates.

By applying these methods, producers can create a more accurate CBS that will improve financial transparency and efficient budget management during the project life cycle.

4. Factor in Uncertainties and Unexpected Expenses

Even with careful budgeting for manufacturing, surprises and setbacks will contribute to additional expenses and delays. To help offset these disruptions, you must incorporate a buffer margin into your Cost Breakdown Structure (CBS). Some typical occurrences that might affect your budget are:

- Labor Shortages: An essential technician or machine operator could get sick, necessitating the replacement of a more expensive employee or compelling overtime labor, which would increase labor expenses.

- Supply Chain Delays: Raw materials may be delayed because of supplier problems, shipping disruptions, or regulatory holdups, compelling production to decelerate or slow down temporarily.

- Environmental and Natural Disruptions: Weather events such as hurricanes, snowstorms, or electrical outages can disrupt facility operations, resulting in downtime and missed schedules.

By including a contingency budget in your CBS, you can accommodate unexpected expenses without sidelining production timetables or pushing past fiscal limits.

5. Take Advantage of CBS Software

Manually estimating costs may consume time and cause errors. Having CBS software enables easy tracking, increased accuracy, and efficient management of budgets. The main advantages are:

- Organized Centralization: Having all project costs, tasks, and assignments in a single platform allows nothing to go unnoticed.

- Greater Accuracy: In-depth tools blend cost estimates with current resource availability, minimizing misestimates compared to ordinary spreadsheets.

- Seamless Team Collaboration: Teams can access shared data, communicate better, and remain aligned on financial limitations and project objectives.

- Data-Driven Decision-Making: CBS software delivers insights into drivers of costs, enabling manufacturers to maximize expenditure and make strategic decisions with informed choices.

Implementing contingency planning alongside proper technology can help manufacturers exercise greater control over budgets, reduce financial hazards, and enhance overall project efficiency.

Final Thoughts

A properly organized Cost Breakdown Structure (CBS) is critical to maintaining cost control and profitability in manufacturing projects. Manufacturers get a clear, fact-based picture of your costs by properly classifying labor, materials, equipment, and overhead expenses and including contingencies. CBS software further increases accuracy, collaboration, and efficiency, allowing manufacturers to remain within budget and respond to unforeseen challenges.

Through the strategic deployment of the CBS, your projects can make costs transparent, mitigate financial danger, and yield long-term successful operations.